Dear Future Moneyqueen👋

Today I want to dive deeper into two crucial strategies that can significantly impact your long-term investment success: compound interest and dollar-cost averaging.

I briefly mentioned the power of compounding in one of my previous newsletters. If you didn’t have a chance to read it yet, you can check it out here. I hear it’s a great read 😉

🔮 The Magic of Compound Interest

Albert Einstein famously referred to compound interest as the eighth wonder of the world - And rightly so. It is a force that can work miracles for patient and disciplined investors. The concept is simple yet so impactful. It allows your money to grow exponentially by reinvesting the returns it generates.

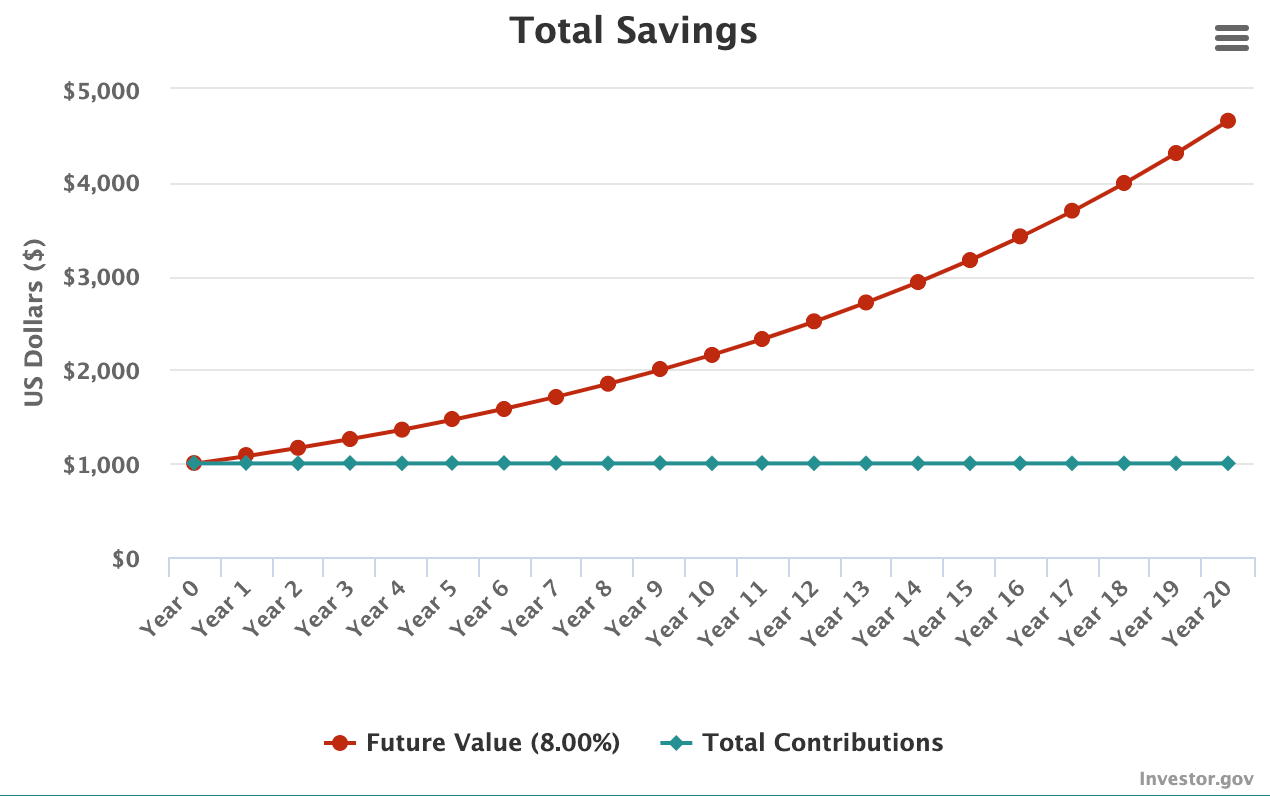

Imagine this: You invest $1000 at an annual interest rate of 8%. In the first year, you'll earn $80 in interest, bringing your total to $1080. However, in the second year, you won't just earn another $80; you'll earn 8% on $1080, amounting to $86.40 in interest and a total of $1166,40. Then the third year you earn 8% interest on that… and so on.

As time goes on, your investment snowballs, and the power of compounding starts to work its magic. This is how, over the course of 20 years, $1000 can turn into $4660.

Might not sound as much, but don’t forget that you only contributed $1000!

The remaining $3660 is the interest amount earned - basically you just sit back and watch your money grow! Doesn’t sound too bad, does it?

One investor who is a perfect example to showcase the compounding effect in action is Warren Buffet. While he’s an incredibly good investor (22% return annually), the majority of his wealth was built, because he started being a great investor when he was still a child.

He started investing seriously when he was 10 years old. That led him to having a net worth of $1 million by the age of 30, or $9.3 million adjusted for inflation.

If however, he had started investing at the age of 30, and retired by the age of 60, his net worth would have “only” been $11.9 million - rather than $112 billion, as it stands today.

That’s 99.9% more.

Simply because he has been an investor for 82 years, instead of 30 years.

Of course, Warren Buffet is an extreme example.

But what I’m trying to show is that time and patience are important factors when it comes to investing.

💰 The Strategy of Dollar-Cost-Averaging

Now let’s look at another one of my favourite investment strategies.

While compound interest harnesses the power of time, dollar-cost-averaging allows investors to navigate the volatility of the market with confidence.

Dollar-cost-averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. By doing so, you automatically buy more shares when prices are low and fewer shares when prices are high.

This strategy avoids you having to try and time the market. It eliminates the need to make emotional investment decisions based on short-term fluctuations and instead focuses on the long-term goal. And the best: You can automate it by setting up a saving plan with your broker, and can then technically forget about it!

Perfect for any woman who claims, she doesn’t have time for investing!

🤝 The real magic is in the mix

The real magic happens, when you combine the two.

By consistently investing over time and using the power of compounding, you set yourself up for remarkable growth. Over the long haul, this disciplined approach can lead to a smoother ride, reduced risk, and better returns.

Consider this scenario: In addition to the $1000 you invested in the beginning, you add a monthly contribution of $500 at an average annual return of 8%.

After 30 years, your investment portfolio will be at $689,761.92.

Of that, $181,000.00 are your contributions and $508,761.92 is the interest earned - All thanks to the power of the compounding effect!

Remember, investing is a marathon, not a sprint.

xxx

Anouk

🚀 Two small announcement regarding…

The german version of this newsletter:

If you have any German friends who might be more comfortable reading this newsletter in German - I have some good news! There is now also a German version of this newsletter, which you can find here:

The newsletter schedule

As I’m getting closer to my due date and I’m realising that my body & mind need more rest, I’ve decided to send out the next newsletters on a bi-monthly basis. That way I can guarantee to still send out content while also honouring what my body needs right now. Sometimes we have to pause and listen! Thank you for understanding!🫶